We achieved strong growth in specialized banking with our expanding portfolio of clients who share a significant role in Turkey’s economy and our unique model of financing trade.

Since 1999, we have been funding the trade endeavors of our steady clientele with a growth perspective. GSD Holding’s long-established experience in commercial banking is the basis of our fast adaptation capabilities. After the sale of Tekstilbank to one of the largest banks in the world, ICBC, we developed the growth strategy of GSD Bank with our knowledge and expertise in commercial banking.

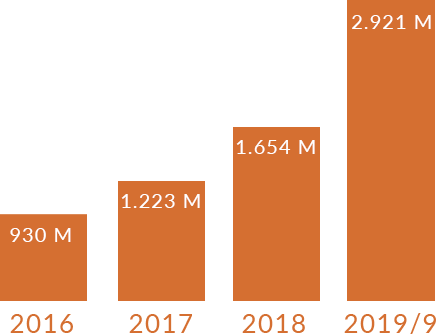

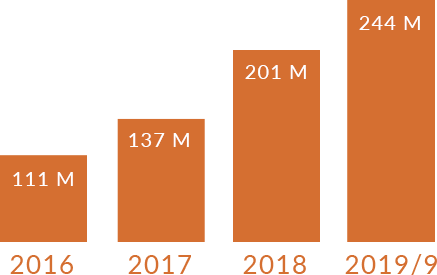

Today, we operate with our equity capital over 240 million TL and total volume of credits issued at nearly 3 billion TL, with a client portfolio of pioneering establishments who create exceptional added value in their fields of business. We contribute to our country’s economy and efficiency in commercial affairs by supplying our clients with short and medium-term cash and non-cash loans, along with guarantee letters required for accessing Takasbank and Eximbank loans.

We prioritize liquidity management in all kinds of economic situations to adapt to the changing market conditions and support our clients with fair pricing and flexible solutions. We aim to create value and sustainable growth through our productivity-oriented perspective and credit utilization ratio.

Loans with a fixed rate of interest that are designed to meet the liquidity needs of companies, collected at maturity with principal and interest.

Loans are extended for short term financing with interest payments every quarter.

Turkish lira based loan against an unexpired commercial note with an advance collection of interest.

Loans repaid with a pre-determined schedule, in equal installments covering the principal and interest.

Foreign currency loans are extended to companies with export revenue.

Letters of guarantee on bid bonds, performance bonds, advance payment bonds issued to the public and private sectors.

Endorsement loan procedures for Rediscount Credits extended by Eximbank to companies which provide assets and inflow of foreign currency via exporting services in collaboration with Central Bank of the Republic of Turkey.

Letters of guarantee issued to Eximbank within the scope of export-oriented Investment Loan and Working Capital Loan programs.

Loan Volume

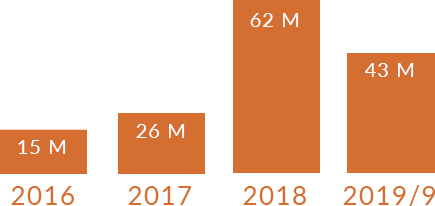

Net Profit

Equity Capital

Aydınevler Mah. Kaptan Rıfat Sok.

No:3, 34854 Küçükyalı Maltepe İstanbul

Mersis No:0411 0082 2800 0017

Koç Kuleleri, Söğütözü Mah.

Söğütözü Cad., No:2

A Blok K:11 Ofis No:34

Çankaya / Ankara

Çınarlı Mah. Ozan Abay Cad.

Ege Perla B Blok No:10 Kat:16

İç Kapı No:164

Konak / İzmir